"I hereby declare upon Oath that I will support and defend the Constitution of the United States of America against all enemies, foreign and domestic; that I will bear true faith and allegiance to the same; that I will bear arms on behalf of the United States; that I will perform work of national importance when needed; and that I take this obligation freely without any mental reservation or purpose of evasion; so help me God."

Tuesday, September 28, 2010

$300,000 Pension?

This is James Hunderfund. Last year he recieved a taxpayer pension of $316,245.

He's not alone, either.

According to the pension search engine at See Through New York, there are several people who recieved a pension from We The Taxpayers in excess of $200,000 in 2009 (16 are listed, but certain persons such as ex-Governors aren't listed).

This is nonsense!

I have a suggestion to help curb our out-of-control state spending: Cap civil service pensions at $90,000 per year. According to my math (and anyone can go to the link above and recheck my math), this would have saved the taxpayers in excess of $63.6 million annually!

And to the 3,760 retired civil servants making more than $90,000 per year in retirement benefits: We The Taxpayers can't afford to subsidize your lifestyle any longer. Our state has a $9 BILLION budget deficit.

In a sense, you could say our state retirement system is "Hunderfund-ed".

Note: I obtained the $63.6 million figure by searching pension recipients for 2009 in excess of $90,000, averaging the first 100 results, subtract $90,000 from the average, and then multiplying by 37.6 to account for 3,760 recipients. If anyone would like to do the math for all 3,760 recipients, be my guest!

Monday, September 20, 2010

A Free Market For Marijuana

First off, let me state this clearly: I don't use marijuana. I have never used marijuana. I dislike the smell of marijuana. Were marijuana legal, I would still not use it.

However, we cannot deny the fact that there is a considerable, and currently illegal, market for marijuana. We spend upwards of $50bn per year at the federal, state, and local levels to enforce drug laws and prosecute drug offenses. Our courts are clogged with drug cases, and our jails and prisons are overflowing with drug-related prisoners.

I am not in favor of legalizing drugs generally. However, I am in favor of legalizing marijuana for two reasons. The first is a simple one: there is no evidence that marijuana use motivates criminal acts in the way which harder drugs can- for example, committing burglary to get money for the next fix. There is also no evidence that marijuana is a public health hazard (one doesn't inject it, after all). If it no more dangerous than alcohol or tobacco, there really is no sense in prohibiting it (and spending money to enforce said prohibition).

The second reason is a bit more involved: I believe legal marijuana trade could be an important source of revenue for the hardest-hit sectors of our economy.

Imagine this: With the stroke of a pen (legalizing marijuana possession and sale), the groundwork would be laid for a brand-new industry, but unlike most fledgling industries, there would already be a demand for the product, to the tune of millions (perhaps tens of millions) of users. And it's a consumable product, to boot.

What better way to engage the hardest-hit sectors of our economy?:

Agriculture- The agricultural sector hasn't just been depressed for the last few years, it has been declining for decades. We now import almost as much food as we produce domestically. A legal marijuana industry would require considerable farming- and farm labor;

Manufacturing- Factories are closing. New factories aren't being built. Factory operations are being pared down- and factory workers laid off in droves. Factories would be needed to process and package this product, and that means factory jobs;

Transportation- The trucking industry gets a boost, too, since you'd need to ship product from farms to factories, and from factories to retailers. That's a large distribution chain, and alot of miles to cover;

Retail- The availability of a new, high-demand product would be a boon to small retailers- especially since major, "family-friendly" establishments such as Walmart would be resistant to selling marijuana;

And of course, starting up this new industry would require venture capital, and lots of it. And small business loans, too. Let's get lenders lending (and making money) again.

Naturally, you'd need a regulatory agency- and this, to me, is especially attractive: We need to cut government spending, and a major opportunity to do so is in government agencies where administrators are fighting to avoid civil service layoffs. A regulatory agency for a marijuana industry could be funded solely with regulatory fees and taxes- in other words, funded solely by those who consume the product. Such an agency would need civil servants, providing a way to transfer thousands of state and local civil service workers from jobs which are taxpayer-funded into jobs which cost nothing to the taxpaying public (at least, those who choose not to consume marijuana). In other words, a free-to-the-taxpayers "dumping ground" (for lack of a better term) for civil service workers who would otherwise collect unemployment at the taxpayers' expense. Add in the savings in criminal justice spending, and it'd be a bargain for the taxpayers.

So, by legalizing marijuana, a substance which presents no measureable public safety harm, we have a means to inject some capitalist revitalization into the hardest-hit sectors of our economy- agriculture, manufacturing, transportation, retail sales, and financial services. We provide a way to soften the blow to some civil service workers whose positions need to be cut for the sake of austerity. And we save the taxpayers billions of public safety dollars.

Now, there is the issue of federal law on the subject of possession of marijuana. Question: does the Constitution expressly grant the federal government the power to create and enforce laws regarding the possession of drugs? Of course not- and so the that law is already invalid. Even if we accept that a lawful trade in marijuana would constitute interstate commerce, federal law would still pose no significant problem for this industry- instead of a few large, national corporations dominating the industry (as is the case with cigarette sales), it'd be fifty or more state-level small businesses, each buying their raw materials from farms and other small businesses within their state, and each selling their product to small retail businesses within their state. No 'interstate' marijuana commerce, no marijuana tax revenues for the federal government.

And on the medical marijuana side, tax-free marijuana (or, alternatively, non-smoking marijuana products) could be sold tax-free through pharmacies, with a prescription.

Is this proposal a "magic pill" to fix our economic woes? Of course not. But it IS yet another example of how the free market can provide much better solutions than government to our economic problems.

Saturday, September 18, 2010

Inspiration

"If ye love wealth better than liberty, the tranquility of servitude than the animated contest of freedom, go from us in peace. We ask not your counsels or arms. Crouch down and lick the hands which feed you. May your chains sit lightly upon you, and may posterity forget that you were our countrymen!"-Samuel Adams

Cutting The United States Budget

As noted in my previous post, for 2010 we have a federal budget structural deficit of $1.17 TRILLION dollars. 55% of the federal budget is spent on entitlement programs. In order to balance the federal budget and stop perennial deficit spending, we MUST cut entitlement programs. It is no longer a question of whether or not we "should" help senior citizens and disabled persons. It is a matter of how much assistance we can afford to provide.

Here's my rough suggestion, in order to start a discussion on the subject:

1) Let's look at the numbers: The estimated payroll tax revenue for 2010 will be $940bn. The budgeted outlay for services funded by payroll will have been $1,992bn (in other words, just about $2 TRILLION). Stated another way, $1.05 TRILLION of the $1.17 TRILLION deficit spending will go to funding Medicare, Medicaid, and other federal welfare programs.

2) Change Social Security from a defined-benefit program to a defined-contribution program. Under the current program, the federal government is mandated to pay a defined benefit ("X" dollars per month) based on the lifetime tax paid, and mandated to increase the amount of payments each year (Cost Of Living Adjustments, or COLA). The government is mandated to borrow money to pay these mandatory payments if social security tax isn't sufficient to cover the expense. Under a defined contribution system, the amount of social security payments would be determined by the amount of Social Security tax collected the previous year, and would not be based on lifetime income and/or lifetime tax paid.

As it stands now, Social Security tax is sufficient to pay Social Security benefits. However, with the expected growth in beneficiaries, by 2017 the tax will not be sufficient. Obviously, this means borrowing a greater amount of money each year.

As an example of how this would work (the numbers used are for illustrative purposes only):

Social Security tax for 2011= $500bn

Social Security funding for 2012= $500bn

Social Security recipients= 50 million

2012 benefit to each recipient= $10,000 or $833 per month for 2012

Under this example, the amount of benefit for 2013 would be determined by the number of new enrollees for 2013 and the amount of Social Security tax collected in 2012, and not based on a COLA formula.

The question begs, then: Who can live on $833 dollars per month? The answer is this: Social Security was NOT INTENDED to fund a lifestyle! It was intended to guarantee a minimal income for those unable to work due to age or disability. The fact that it has morphed over time into a lifestyle entitlement doesn't justify keeping it as such, especially when we can't afford it any more!

3) The health services paid by Medicare and Medicaid must be greatly reduced. Some of the benefits given are truly ridiculous (i.e. taxpayer-supplied erectile dysfunction treatments), and some are truly wasteful (taxpayer-supplied multi-thousand-dollar electric scooters). Again, the amount of money doled-out must not exceed the amount of money collected the previous year. It is a fallacy to believe that we can afford to pay most of the costs of healthcare for the 'sickest' portion of the public. It's not a matter of whether we would "like to help" the elderly and the disabled. We simply cannot afford to do so.

4) Responsibility for the State Children's Health Insurance Program (SCHIP) should be fully transferred to the states. The total federal expenditure for SCHIP for 2009 was $9.2bn- in other words, less than 1% of the amount of federal individual income tax collected. I am going to go out on a limb and say that there is plenty of wasteful spending to be cut at the state level to cover this amount.

Incidentally, the primary purpose of reorganizing SCHIP would be to prevent it from being used by Congress as a loophole to engage in further deficit spending through expansions of the program. A $9.2bn "Children's health program" could easily become a $920bn "Children and Families program"- in other words, a single-payer health care system for the entire nation. As a side benefit, the taxpayers would save a little money, since SCHIP, like Medicaid, is a partnership between the federal and state governments, who have redundant administrative costs. Save the taxpayers the federal administrative costs and have the taxpayers pay the tax directly to their state government, or cut from other areas by the equivalent amount.

5) Place a cap on payroll tax rates. Period. Prevent FICA from growing into a second major income tax. Also, place a ban on the expansion of programs funded by FICA.

6) Federal unemployment expenditures should only cover federal employees. Let the states handle unemployment at the state level. In a future post, I will lay out my concept of unemployment insurance and state pension reform (they're two parts of the same proposal).

I recognize that all of this represents severe cuts in public welfare programs. There are needy people in our country. However, it is not the role of government, funded by the taxpayers, to provide for the needy. It is the role of families and charities to do so. Assistance should be just that, assistance.

Discuss.

"It Can't Happen To Me"

The topic of home invasion crimes is hotly-contested, even within the "tactical community" elite of self-defense-oriented gun owners and trainers. Some believe that special preparation for this class of crime is not needed, since an individual's risk of being the victim of this crime is statistically low; however, as we have learned from the tragic story of Dr. William Petit in Connecticut, one cannot afford to believe that this crime "can't happen to me".

Dr. Petit's daughters were tied to their beds, raped and tortured, and then burned alive. Scroll back up to the photo and look at their faces, and as you do so, recite the words "raped", "tortured", and "burned alive".

His wife was kidnapped, taken to a bank and forced to withdraw money for the criminals- and then she was taken back to the house, raped, forced to watch her daughters burn to death, and then murdered. Dr. Petit's torture is worse than death. His wife and daughters were horribly murdered, and he has to live with the knowledge that he escaped and was powerless to save them.

This was an upper-middle-class family, living in an upscale community with an exceedingly low crime rate.

In fact, home invasion crimes are most often committed against nuclear, well-to-do families in upper-middle-class neighborhoods, because the primary motive for this class of crime is a combination of profit and class envy. These criminals deliberately target, and seek to "punish", those who appear to be wealthy. The information contained in this document, which discusses Asian gangs in California, is equally applicable to all home invasion criminals anywhere in the United States.

There is also considerable criticism about the police response in the Petit case- specifically, that the police were notified, via bank personnel, of Mrs. Petit's situation, and that their response based on the information in hand was inappropriate, and that the Petit's daughters may have survived if the police response had been more fitting to the circumstances. I won't comment on this until more information develops.

The two criminals in this case were also lifetime predicate offenders, with numerous prior convictions for violent crimes.

LESSON: Self-defense is your inalienable right, your prerogative, and your sole responsibility. In this case, as in most self-defense cases, both the courts and the police were not able to prevent this atrocity. Horrific crimes can happen anywhere, to anyone.

I will note that, as I write this, this very topic is being discussed on Geraldo At Large on Fox News. Amazingly (and satisfyingly), host Kimberly Guilfoyle- a former ADA from Los Angeles, and the ex-wife of Gavin Newsom- and her guest, Rod Wheeler, a former homicide detective from Washington, D.C., are in agreement about advice on home protection: (paraphrase) "make the decision to be a VictOR rather than a VictIM", develop a security plan for your home and discuss it with your family, own firearms, train everyone in the home to use them, and specifically, store a handgun under the bed where it can be accessed from the floor, as many home invasion criminals will force the homeowners out of bed and onto the floor. I would take this as virtually definitive advice- a homicide investigator from D.C., the nation's "murder capital" (and where handguns were illegal until 2008) believes this can prevent many home invasion crimes, and a former Los Angeles criminal prosecutor agrees with him.

This advice is exactly what the most knowledgeable elite of the "tactical community" have been espousing for decades- Mindset, Preparation, and Tactics.

Tuesday, September 14, 2010

Medal Of Honor- Salvatore Giunta

Official Citation:

Then-Specialist Salvatore A. Giunta distinguished himself by acts of gallantry at the risk of his life above and beyond the call of duty while serving as a rifle team leader with Company B, 2d Battalion (Airborne), 503d Infantry Regiment during combat operations against an armed enemy in the Korengal Valley, Afghanistan on October 25, 2007. When an insurgent force ambush split Specialist Giunta’s squad into two groups, he exposed himself to enemy fire to pull a comrade back to cover. Later, while engaging the enemy and attempting to link up with the rest of his squad, Specialist Giunta noticed two insurgents carrying away a fellow soldier. He immediately engaged the enemy, killing one and wounding the other, and provided medical aid to his wounded comrade while the rest of his squad caught up and provided security. His courage and leadership while under extreme enemy fire were integral to his platoon’s ability to defeat an enemy ambush and recover a fellow American paratrooper from enemy hands.SSgt Giunta (bio) will be the first living recipient of the Medal of Honor for action since the Vietnam War.

Friday, September 10, 2010

Shades Of 1994- Democrats Poised To Pass More Gun Control

In September 1994, the Democrat majority in Congress, realizing that they were about to lose their majority, rushed the 1994 "Assault Weapons Ban" into effect. Now, in September 2010, Congressional Democrats, realizing they are about to lose their majority, are preparing to do it again.

The 1994 law, which illegalized the further purchase of firearms possessing certain cosmetic features (namely, a carrying handle, heat shield, protruding grip, flash suppressor, or adjustable buttstock) and the further sale of magazines holding more than ten cartridges, stood until 2004, when the law sunset without renewal. It still stands as state law in several states, including here in New York.

Predictably, the law has had no effect on crime whatsoever. It has, however, denied firearms most suited to home defense to residents of high-crime cities. Most professional firearms instructors agree that a short, high-capacity rifle of intermediate caliber is the type of weapon most suitable for repelling home-invasion robberies, since such a firearm combines four qualities not found together in any other type of firearm: compactness needed to maneuver in the confines of a home; ability to penetrate body armor often used by such criminals; low risk of over-penetration which would endanger other occupants of the home and neighbors; and a low probability of needing to reload during a prolonged fight, which often proves disastrous to the defender.

Also predictable is the fact that fewer than 0.2% of "assault weapons" have ever been used in the commission of a crime, according to the FBI.

Then again, we shouldn't have to provide justification for exercising a Constitutional right.

Socialists, of course, have their own (thoroughly discredited) justifications and statistics to throw around- in favor of limiting the exercise of a Constitutional right. But I won't dignify sophistry here.

I will, however, quote Benjamin Franklin: "Those who would surrender essential liberty for a little temporary safety, deserve neither liberty nor safety".

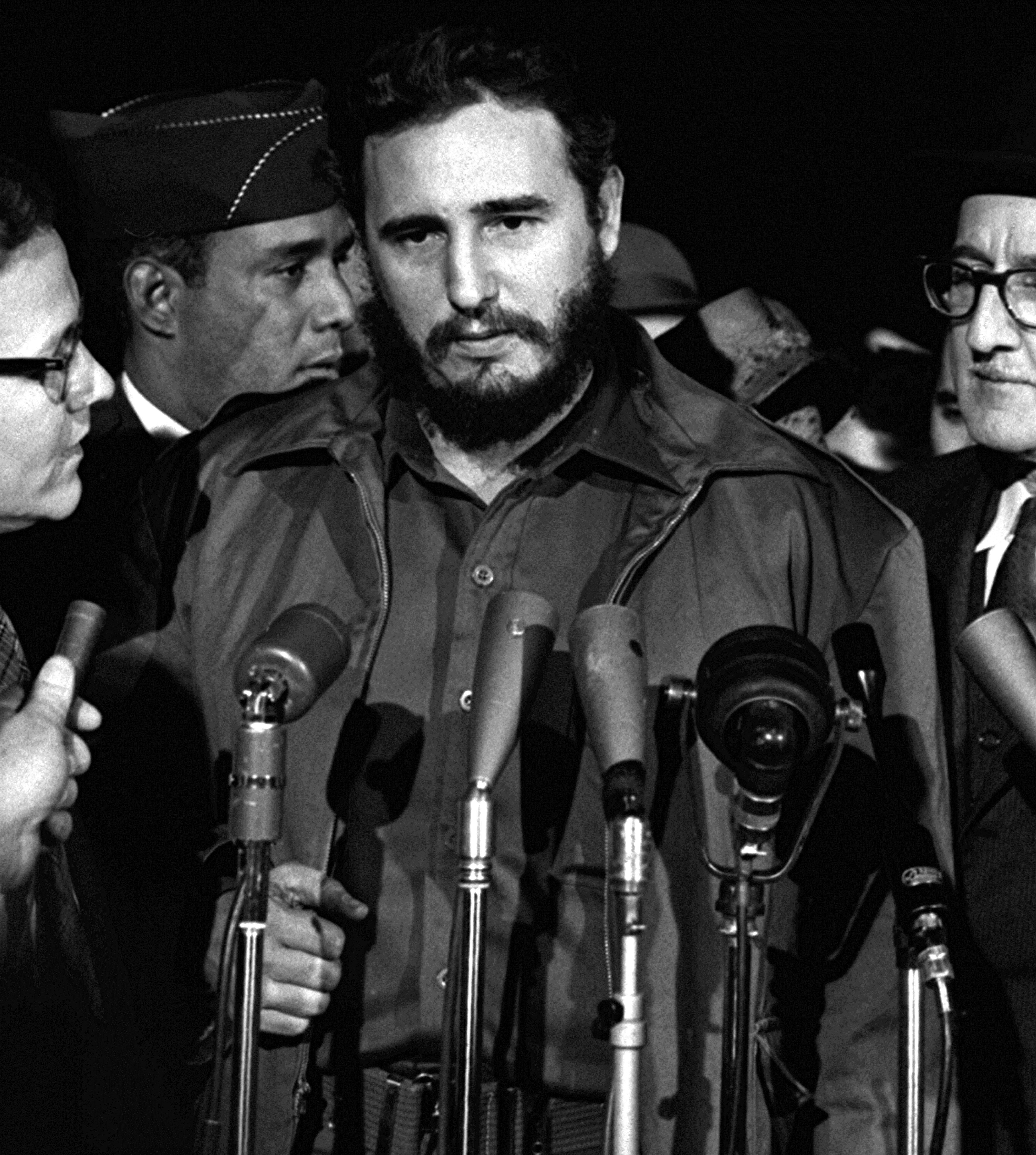

Castro: Socialism Doesn't Work

Fidel Castro has admitted that the Cuban model of socialism doesn't work!

Excerpts:

Even after the fall of the Soviet Union, Cuba has clung to its communist system.

But the president has also made it clear he has no desire to depart from Cuba's socialist system or embrace capitalism.So, even though communism has failed everywhere in the world (except China, which is continuously changing from a socialist state into a fascist state), they still believe it can work? Evidence be damned, says the idealogue!

The state controls well over 90 percent of the economy, paying workers salaries of about $20 a month in return for free health care and education, and nearly free transportation and housing. At least a portion of every citizen's food needs are sold to them through ration books at heavily subsidized prices.So... State-controlled economy (GM? Student loans? Goldman Sachs?); workers are paid $20 a month (high taxes?); free healthcare (Obamacare?), education (USDE?), transportation (Billions of dollars in recent infrastructure spending?), and housing (HUD?). Hmm...

President Raul Castro and others have instituted a series of limited economic reforms...Like their convertible peso scheme, which shows the extreme dangers of allowing a government to own a fiat currency.

If ever one needs modern-day proof of the evils of socialism, I have a suggestion: go to Florida, find a few Cuban ex-pats, and ask them their opinion of socialism. Most of them are Republicans for a reason.

Thursday, September 9, 2010

What Do You See?

The picture above (larger version here) is a pie chart of the 2010 United States federal budget, as proposed by President Obama.

When you look at the picture, what do you notice immediately? I assume you noticed the five largest "slices", as I did. Those five slices, constituting 75% of the federal budget, represent proposed spending for the following (by order of size):

1. Department of Defense (dark blue);

2. Social Security (rust);

3. Federal welfare programs (olive green);

4. Medicare (purple);

5. Medicaid (light blue).

The other 25% (all of the other, smaller slices) represent all other federal spending, including the sixth-largest slice (dark tan) representing interest payments on the national debt.

Look at this another way: 55% of the federal budget is spent on entitlement programs!, 20% on national defense, 5% on interest on the national debt, and 20% on everything else.

By the way- this budget is 3.55 trillion dollars, whereas the projected federal reciepts for FY 2010 were 2.38 trillion dollars. In other words, President Obama proposed a budget with a structural (known) deficit of 1.17 trillion dollars (and God-only-knows-how much unpredicted deficit spending).

Let's use personal budgeting to put this in perspective: Imagine you make $24,000 dollars per year (projected reciepts), but spend $35,000 per year (federal budget), including giving $19,000 each year to charity (welfare), knowing that you will accumulate $11,000 each year in new credit card debt (borrow from China), in addition to unforseen expenses- like car repairs- which you also borrow (from China) to pay, and your total credit card debt is $140,000 (national debt). You'd have to be insane! YET, if you add eight zeros to each of these numbers, you have a pretty good approximation of our federal spending.

It gets worse: the expenditure for interest payments on the national debt (note that there are no principal payments on the debt in this budget, as- shocker- we can't afford them) does not reflect interest payments on new debt acquired through borrowing for bailout programs. By 2012, when interest begins to accumulate on that debt, our total debt interest will be an estimated $600 billion annually, equivalent to our total defense spending (the biggest slice of the pie above)! This figure comes from Admiral Mike Mullen, Chairman of the Joint Chiefs of Staff, who now considers our national debt "the greatest risk to our national security".

Lesson: It is WELFARE spending which is breaking us!

Wednesday, September 8, 2010

National Rifle Association: More Harm Than Good

From the time of his departure from the NRA brass, until his death in 2005, Neal Knox was the leading voice publicizing the waste, corruption, and poor decision-making at NRA headquarters. His son has since taken up the banner. This letter describes yet another example of the same ongoing mismanagement:

House Bill 571, which was introduced by Joe Uecker, 66th District Representative, and is co sponsored by 30 other representatives, would amend section 2923.126 of the Ohio Revised Code. The law would not allow private employers to prohibit a concealed carry permit holder from storing the employee's handgun in a locked motor vehicle on the employer's premises. Any current employer policy prohibiting such would have to be amended.This is the latest in a series of such attempts by the NRA to amend state laws to allow the practice of storing weapons in vehicles at workplaces, the first arising in Oklahoma 5 years ago.

Let me be very clear: I am strongly in favor of concealed carry. However, this is an example of a conflict between two rights: The Second Amendment rights of the employee, and the property rights of the employer. Benjamin Franklin already gave us a rule of thumb for resolving such conflicts- "Your right to swing your fist ends at the tip of my nose".

This is, however, typical of the NRA: while the NRA is busy trying to erode the Ninth Amendment right of employers to determine who may or may not possess a firearm on their private property, they are completely ignoring major gun-rights issues. For example, several cities in Texas are passing, or have passed, ordinances which forbid storing a firearm in an unattended vehicle. This is especially a problem in Texas, where the state penal code contains a several-pages-long list of places and times where a person may not lawfully exercise their right to carry a handgun, and so handguns are frequently left in a vehicle. An ordinance which bans the storage of a firearm in an unattended vehicle effectively converts a "license to carry a handgun" into a "license to store a handgun at home".

What's the difference between this ordinance and the Ohio example? Simple: A public parking space isn't private property!

I could go into the major missteps at NRA headquarters, and the corruption, and the wasted money, but I would get writer's cramp. Suffice it to say, I support two other organizations: Gun Owners of America and Jews For The Preservation Of Firearms Ownership. Both are cleanly-run, fiscally-responsible, ardent Second Amendment organizations.

Mindset

"Commit to study acts of bravery and valor; emulate them. Do not cast your life away as a coward. One way or another, death will come. Resolve now how you will face it."-Daidoji Yuzan, Budoshoshinshu

Tuesday, September 7, 2010

The Paradox Of Thrift

This is a WSJ article written by Kelly Evans, one of my favorite TV commentators, in which she describes the great fallacy of today: That anyone, including "Middle America", can (or will) spend us out of recession.

I'd like to take this one step further: I see this phenomenon as a fundamental failure of personal responsibility. We already accept that freedoms come with responsibilities, but irresponsible consumerism has brought us to the brink of financial ruin.

I'm going to tip a sacred cow here: I believe this irresponsibility started with "The Greatest Generation", the World War II generation. The generation who came through the Great Depression, beat the Nazis and the Fascists and the Imperial Japanese- and then came home to live the American Dream.

What was "The American Dream"? "A house with a white-picket fence", a "good -paying (union) job with good (union) benefits", etc. "The good life" became defined by advertisements for brand-name products. That generation spent more- consumed more- than any previous American generation. People became defined by the value of their possessions. And this generation taught their children, who repeated the cycle in their own adulthood, and who took the notion a step further-

"Everyone deserves a chance at the American Dream".

In order to facilitate "everyone's chance" to own "the house with the white-picket fence", mortgage lenders were barred from considering the ability to make payment when deciding to approve or deny a loan. Housing prices inflated with the increased demand. In order to facilitate the "good-paying (union) job with good (union) benefits", the influence of labor unions drove up the costs of payroll, benefits, and retirements to unsustainable, bankrupting levels. Rabid consumerism paid the costs of these union programs, for awhile.

And now the bubble has burst.

Demonstrating the pervasiveness of Keynesian economic principles, the public seem to believe that "the public" (i.e. "everyone else") should spend every available dollar to "jump start the economy". Thankfully- and this brings us back to Kelly's article- some people are becoming responsible with their money.

Is this a condemnation of the capitalist system? ABSOLUTELY NOT! It is a failure of the entitlement mentality ("I deserve -blank-"), and the failure of unsustainable spending.

People are more conservative with their own money these days. Let us hope that, come November, they will vote to be more conservative with other people's money, too.

Constitutional Vs. Judicial Activism

Faced with the nomination of two blatant activist judges to the U.S. Supreme Court, it's refreshing to see a judge bringing activist judges to task.

Enter Judge Andrew Napolitano- constitutional activist, former New Jersey state court judge, and self-professed libertarian. In other words, my kinda guy.

I have read his newest book, "Lies The Government Told You", and I firmly believe every American should read it. We need more Constitutional clarity these days.

Here's a review.

Friday, September 3, 2010

Where's The Gold?

Rep. Ron Paul (R-TX) has called for an audit of the gold reserve at Fort Knox:

The link above is a bit of a long read, so I'll break it down more succinctly- Ron Paul believes (and has good reason to believe) that the gold supply at Ft. Knox may be over-reported, or largely promised to cover foreign debts.

Or worse, non-existant.

Let us go back to the Constitution (as we always should). The Constitution authorizes Congress to "coin money" (to mint gold or silver coins), not "print money" (paper bills) for a reason: in order to make a $20 gold coin, you need $20 worth of gold. Not only does this render counterfeiting impractical, but- more importantly- it prevents government from inflating the amount of money in circulation. Exchange systems, wherein a paper bill can be directly exchanged for an equal quantity of precious metal, though counterfeitable, serve the latter purpose almost as well.

The problem is this: A lack of immediate exchangeability allows the government to print money it doesn't have. Exchange was suspended during the Civil War (to print non-existant money to pay for the war); then again during FDR's presidency- during the transition from the gold standard to the silver standard, the dollar was "re-valued", effectively allowing the "expansion of the money supply"; and then during Nixon's presidency, in order to pay for the Vietnam War, the dollar became permanently non-exchangeable.

So, how is money valued now? It isn't! The U.S. dollar, like most currencies today, has no intrinsic value. The dollar have some perceived value, however- the possibility that a gold or silver standard could be resurrected, thanks to... drumroll, please... Our Gold Reserve At Fort Knox! So, if Ron Paul is right, and the amount of gold at Ft. Knox is over-reported, then the value of the U.S. dollar effectively becomes ZERO, overnight.

Now, let's say the quantity of gold has been reported accurately, and little-to-none of it is promised to cover foreign debts. We still have a looming problem: hyperinflation. The Federal government is 14 TRILLION dollars in debt, and growing rapidly. Much of that debt is held by other nations not friendly to us, such as Communist China. What will we do when China demands payment on the debt? We will, of course, print all the money needed to pay that debt, and the dollar will be horribly devalued as a result. This happened is Germany, circa 1921:

The link above is a bit of a long read, so I'll break it down more succinctly- Ron Paul believes (and has good reason to believe) that the gold supply at Ft. Knox may be over-reported, or largely promised to cover foreign debts.

Or worse, non-existant.

He said there is "reason to be suspicious" about U.S. gold holdings and suggested officials were manipulating the price of gold to prop up the perceived value of paper money. Paul said "it is a possibility" that neither Fort Knox nor the New York Federal Reserve vaults have any gold.Why is this cause for concern? After all, the US dollar hasn't been standardized to gold since the Nixon administration, so why have gold reserves at all?

Let us go back to the Constitution (as we always should). The Constitution authorizes Congress to "coin money" (to mint gold or silver coins), not "print money" (paper bills) for a reason: in order to make a $20 gold coin, you need $20 worth of gold. Not only does this render counterfeiting impractical, but- more importantly- it prevents government from inflating the amount of money in circulation. Exchange systems, wherein a paper bill can be directly exchanged for an equal quantity of precious metal, though counterfeitable, serve the latter purpose almost as well.

The problem is this: A lack of immediate exchangeability allows the government to print money it doesn't have. Exchange was suspended during the Civil War (to print non-existant money to pay for the war); then again during FDR's presidency- during the transition from the gold standard to the silver standard, the dollar was "re-valued", effectively allowing the "expansion of the money supply"; and then during Nixon's presidency, in order to pay for the Vietnam War, the dollar became permanently non-exchangeable.

So, how is money valued now? It isn't! The U.S. dollar, like most currencies today, has no intrinsic value. The dollar have some perceived value, however- the possibility that a gold or silver standard could be resurrected, thanks to... drumroll, please... Our Gold Reserve At Fort Knox! So, if Ron Paul is right, and the amount of gold at Ft. Knox is over-reported, then the value of the U.S. dollar effectively becomes ZERO, overnight.

Now, let's say the quantity of gold has been reported accurately, and little-to-none of it is promised to cover foreign debts. We still have a looming problem: hyperinflation. The Federal government is 14 TRILLION dollars in debt, and growing rapidly. Much of that debt is held by other nations not friendly to us, such as Communist China. What will we do when China demands payment on the debt? We will, of course, print all the money needed to pay that debt, and the dollar will be horribly devalued as a result. This happened is Germany, circa 1921:

Although the inflation ended with the introduction of the Rentenmark and the Weimar Republic continued for a decade afterwards, hyperinflation is widely believed to have contributed to the Nazi takeover of Germany and Adolf Hitler's rise to power. Adolf Hitler himself in his book, Mein Kampf, makes many references to the German debt and the negative consequences that brought about the inevitability of National Socialism. The inflation also raised doubts about the competence of liberal institutions, especially amongst a middle class who had held cash savings and bonds. It also produced resentment of Germany's bankers and speculators, many of them Jewish, whom the government and press blamed for the inflation.[12]The Germans called the hyperinflated Weimar banknotes Jew Confetti.But of course, that can't ever happen here, right? And Ron Paul is just a right-wing nutcase, isn't he?

Wednesday, September 1, 2010

We The (Native) People

Much ado has been made about New York State's attempt to collect taxes on cigarettes from Native American nations, including the newest scheme, taking effect today: Requiring cigarette distributors to collect the tax prior to delivery to Native American retailers.

http://www.buffalonews.com/city/article105375.ece

http://www.cnycentral.com/news/politics/story.aspx?id=503205

Quote:

“The continued aggression from the state has to be met and dealt with by our people, by the Six Nations leadership. So if we are going to have a future we need to be able to come together, to build that foundation once again and to work together toward that common goal”.

Does this sound familiar to you?

"For cutting off our trade with all parts of the world"The State of New York is badly in debt, paying out large sums of money for social welfare programs, six-figure salaries and unsustainable pension schemes for state employees, and the like. Rather than making reasonable cuts to state spending, Governor Paterson has engaged in underhanded tactics to "balance the budget" on paper. These measures include withholding tax incentives due to small businesses, cutting road construction funds (which, in fact, will be fully paid with federal stimulus funds), and, of course, increasing the cigarette tax and attempting to unlawfully force Native American nations to pay said tax.

"For imposing taxes on us without our consent"

"He has abdicated government here, by declaring us out of his protection and waging war against us."

"In every stage of these oppressions we have petitioned for redress in the most humble terms: our repeated petitions have been answered only by repeated injury."

If we fall into the trap of believing the taxation issue to be a social concern- "public health", "encouragement to quit smoking", etc.- we succumb to the trap. This is about the State's crack-addict spending.

Subscribe to:

Posts (Atom)